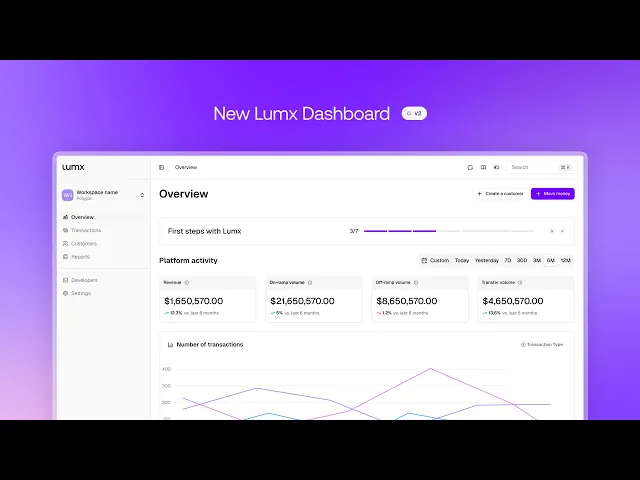

Lumx is launching its new Dashboard, a fully redesigned environment that allows companies to operate global payments, treasury, and liquidity with the same fluidity as the world’s leading financial platforms.

The goal is straightforward: turn the technology behind stablecoins into something simple, visual, and secure, enabling any company, from fintechs to digital platforms, from marketplaces to financial institutions, to move money at internet speed without compromising compliance or governance.

Designed for Product, Operations, and Engineering teams, the new Dashboard consolidates everything in one place: customer creation, wallets, payment routes, transactions, FX, fees, limits, and technical documentation.

From onboarding to payout, everything becomes clearer. Everything becomes faster.

A Scalable Experience: Clear, Intuitive, Complete

The new Dashboard was designed around three core principles:

Optimized UX - turning complexity into clarity

All flows were reorganized to reduce friction, remove unnecessary steps, and ensure anyone immediately understands where they are and what to do next.

Unified visualization - everything in one place

Balances, transactions, customers, fees, compliance, conversions, and payment rails appear in a unified, transparent interface with real-time updates.

Governance and security - built into the platform

From key creation to customer management, everything runs under banking-grade standards, with continuous monitoring and integrated verification models.

What You Can Do With the New Dashboard

While simple to use, the Dashboard reflects a sophisticated financial infrastructure. Below are the main pillars — all accessible through the interface, with no code required.

Create and Manage Customers with Integrated KYC/KYB

Customers represent the entities moving money inside the platform, businesses or end users.

From the Dashboard, you can:

Create and register customers

Track the full KYC/KYB flow (NOT_STARTED → UNDER_VERIFICATION → APPROVED)

Upload missing documents and review temporary rejections

Access the complete history of each entity

Lumx performs all verification automatically or assisted, depending on jurisdictional risk, always compliant with AML, CFT, and local regulations.

Wallets Automatically Provisioned

When you create a customer, Lumx generates, instantly and with no extra setup, a stablecoin account with:

Multi-chain support (Ethereum, Polygon, Base, Tron)

USDC and USDT in BRL, USD, and EUR

Continuous transaction monitoring (via Chainalysis)

Enterprise governance and entity segregation

Create it, and start operating immediately.

Simple Configuration of Bank Accounts

Any fiat payout requires configuring bank accounts associated with a customer.

Through the Dashboard, you can:

Add business bank accounts across jurisdictions

Set the account relationship (SELF, SUPPLIER, BUSINESS_PARTNER, SUBSIDIARY, etc.)

Bind each account to a specific rail (PIX, SEPA, SWIFT, ACH, Wire…)

Individual accounts will be supported starting Q4/2025.

Global Payments With Complete Rail Coverage

The Dashboard enables global payments using a powerful mix of rails:

Available today

PIX 🇧🇷 — Instant

SWIFT 🌐 — 1–5 bussiness days

ACH 🇺🇸 — 1–2 days

Wire 🇺🇸 — Same day

SEPA 🇪🇺 — Instant up to $100k

Coming soon

SPEI 🇲🇽 — Q4/2025 — Instant

ACH 🇨🇴 — Q1/2026 — 1 bussiness day

Transfers 3.0 🇦🇷 — Q1/2026 — Instant

Instant Payments 🇬🇧 — Q1/2026 — Instant

The Dashboard shows timelines, cut-off hours, fees, and availability for each rail.

Transactions: How Money Moves in Lumx

Every financial movement is a transaction — and the Dashboard displays every stage, status, and detail.

Lumx supports three types:

On-Ramp

Fiat → Stablecoin (with deposit through a rail)

Off-Ramp

Stablecoin → Fiat (with settlement to a bank account)

Transfer

On-chain movement between customers or external wallets

Each transaction shows:

Status (AWAITING_FUNDS, PROCESSING, SUCCESS, FAILED…)

Payment instructions

Rail details

Fees

Receipts

Blockchain hash

Timestamps

All in real time, with clear flows for operations teams.

Exchange Rates: Floating & Locked, Now Transparent and Intuitive

The Dashboard displays FX conversions with full clarity:

Floating Rate

Real-time variable pricing

Ideal for simple UX

No additional fees

Locked Rate

Guaranteed rate for 10s, 30s, 1m, or 5m

Great for quotes, checkout, or guaranteed payments

Additional fees for locks beyond 10 seconds

The interface shows:

Remaining time

Origin and destination currencies

Exact amounts

Quote ID

Expiration

Partner Fees: Integrated Monetization

Companies can earn revenue from every transaction processed through Lumx.

In the Dashboard, admins can:

Create percentage fees (bps)

Create fixed fees

Set different fees for On-Ramp and Off-Ramp

Define default fees

Apply fees to Floating or Locked Rate flows

Track accumulated revenue in real time

All fees are automatically credited to a partner-defined wallet.

Compliance: Deep, Automated, and Straight to the Point

Lumx integrates a complete compliance framework:

Beneficial Owners

KYC (individuals)

KYB (businesses)

Standardized minimum collection

Document versioning

Automated validations

Documentation Requirements

IDs, proof of address, articles of incorporation, ownership structure, financial statements

Limits

Defined by KYC/KYB level

Scalable via Enhanced Due Diligence

Prohibited Activities

The Dashboard lists banned activities such as:

Unlicensed financial services

Unregulated remittances

Illegal gambling

Restricted-goods sales

High-risk activities

Sandbox: Your Complete Testing Environment

From the Dashboard, you can:

Generate Sandbox keys

Create mock customers

Test real transactions on testnet/devnet

Validate errors, limits, flows, returns, and callbacks

Simulate the full lifecycle before going live

The Sandbox environment mirrors Production — with zero risk.

Why the New Dashboard Matters

Lumx was built to become the digital money infrastructure for Latin America.

This new Dashboard is that vision made tangible: a simple operational layer on top of sophisticated technology.

It enables companies to:

Launch financial products without a crypto team

Operate global payments with native compliance

Scale digital treasury with governance

Reduce settlement costs and timelines

Use stablecoins as a means, not an end

All with a clear, intuitive experience.

The Future of Lumx Is Already Live

The new Dashboard is just the starting point.

In the coming months, new modules will roll out — including virtual accounts in BRL, MXN, USD, and EUR, fiat-to-fiat FX, new rails, and smart reporting.

Companies are entering an era where stablecoins become invisible infrastructure — and Lumx is building the rails for it.

The Dashboard is already available.

So is the future of global finance.